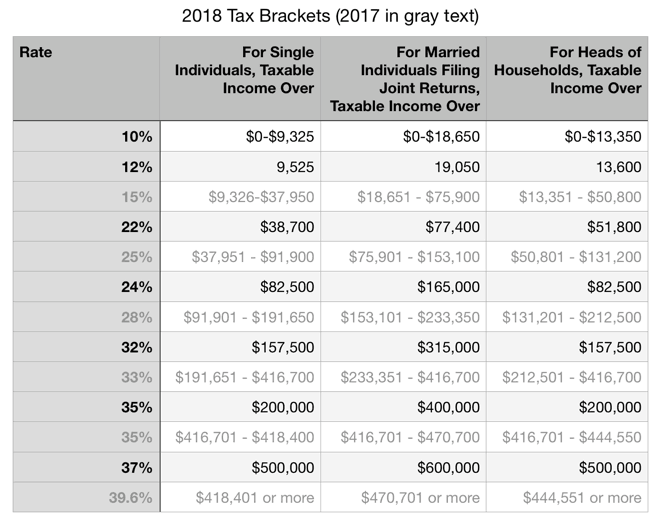

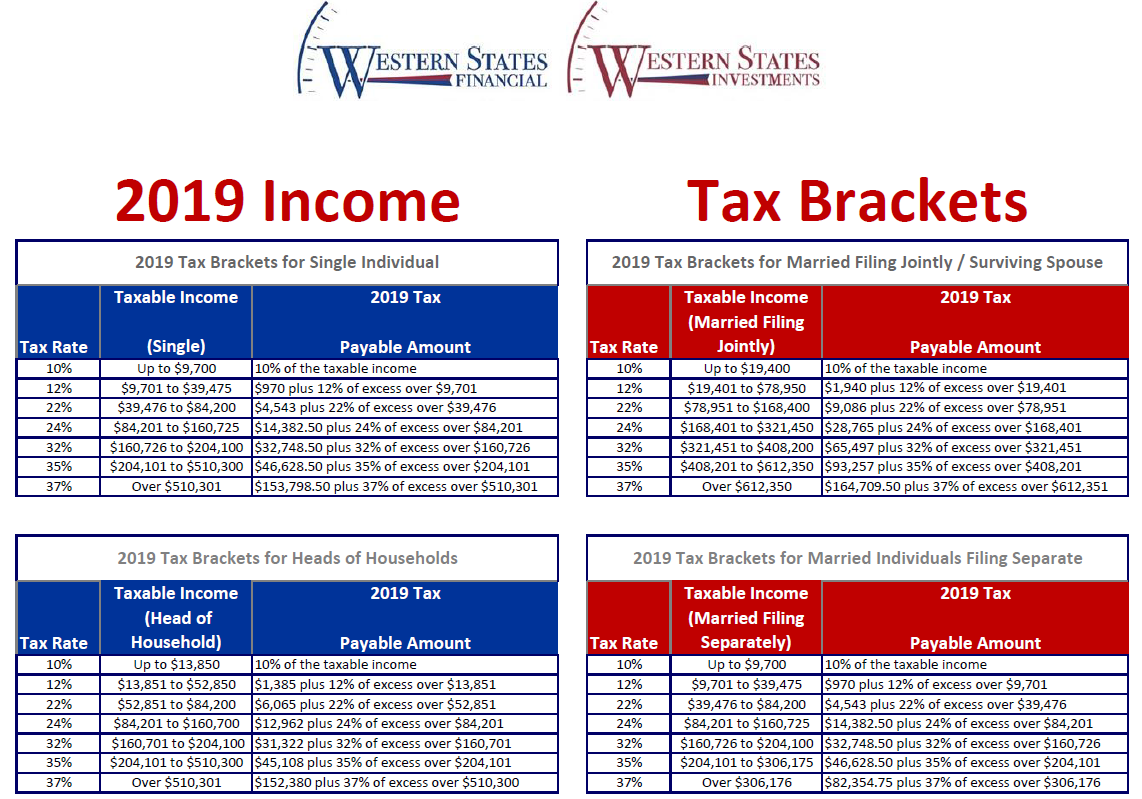

Note the brackets are different depending on your filing status. Rates are subject to change every year and 2019 rates are different from 2020 rates - Official IRS 2019 Tax Brackets and Rates. Remember to start with your taxable income, which is your adjusted gross income minus your standard deduction or itemized deductions. Use this table to calculate the tax rate and tax brackets for filing your 2019 federal income taxes.

#2019 TAX BRACKETS HOW TO#

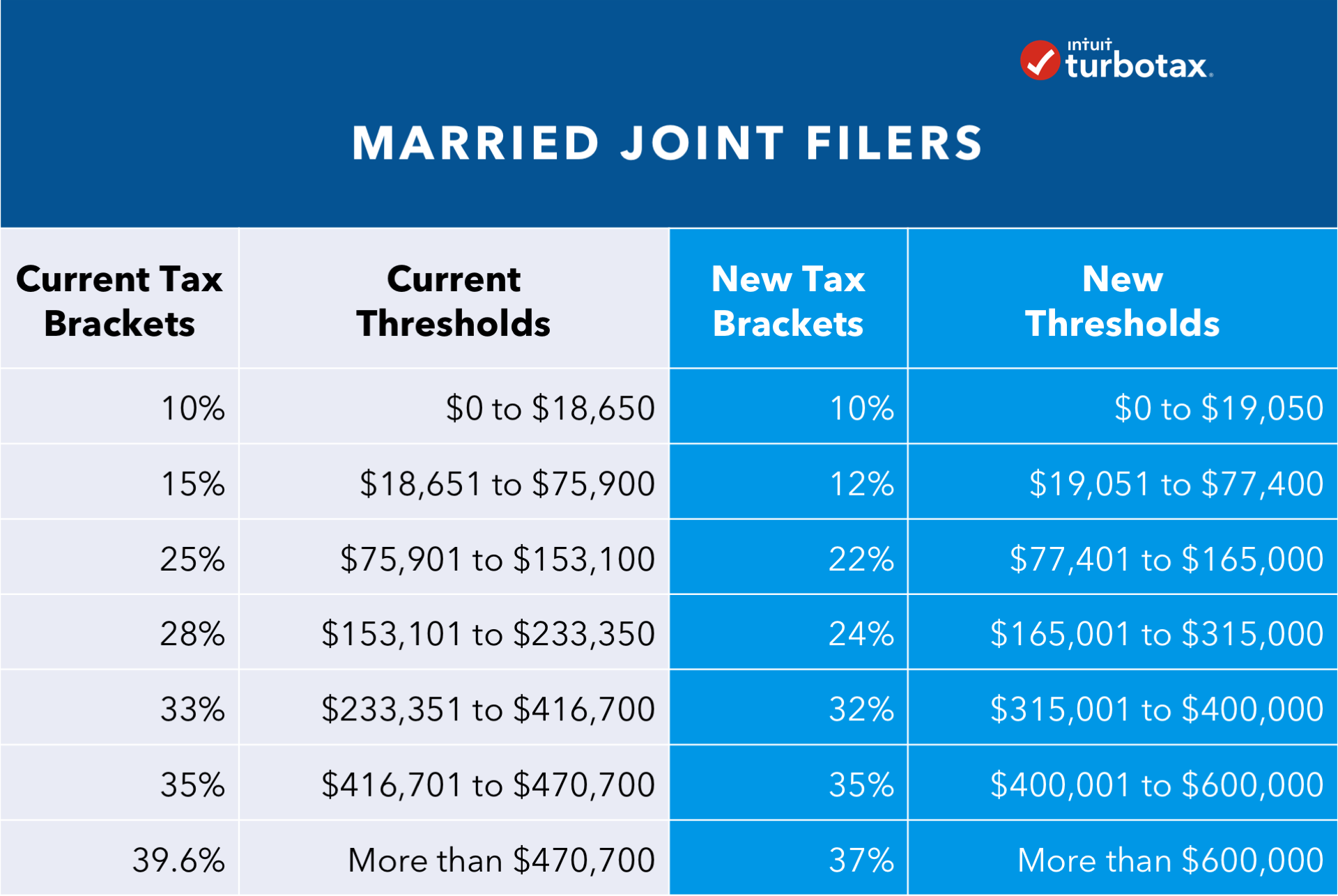

Tax rates and brackets are subject to change annually but the way to determine how much you pay and how to use the tax brackets always remains the same. The same principle can used for any filing status and tax year. This is what's known as 'progressive taxation' and can confuse a lot of people but an example can help illustrate how this works.īelow you will find tables for the two most current year tax brackets and rates, as well as a example section on how to use the tax bracket table (example uses a US median household taxable income and a common filing status). It's important to note you only have to pay the tax rate on the amount your taxable income falls into for each tax bracket. There are seven tax rates ranging from 10% to 37% as of 2020. Federal income tax rates are determined by your filing status and your taxable income for the year - your adjusted gross income minus either your standard deduction or allowed itemized deductions. The tax rate increases progressively the more you earn and is divided into income tax brackets.

0 kommentar(er)

0 kommentar(er)